- The Sleuth

- Posts

- Mastercard’s Latest Crypto Expansion, Wall Street’s Blockchain Greenlight & More

Mastercard’s Latest Crypto Expansion, Wall Street’s Blockchain Greenlight & More

Also: Citi launches stablecoin trial.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

Stablecoin Flows: Citi and Swift trial direct fiat-crypto settlements.

Crypto Transfers: Mastercard extends its Crypto Credential programme.

Holding Crypto: US banks may now hold crypto to pay transaction fees.

Ray Dalio, the godfather of macro, is now parked in Bitcoin. That’s the tell, folks.

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Unsung Sherpas

The gospel of forward-deployed engineers (FDEs) says startups scale faster by planting developers inside their customers’ offices; the sceptics say it’s just a boutique service with a tech twist.

Buzzwords aside, forward-deployed engineers are exactly what the crypto industry increasingly needs.

As blockchain technology drifts closer to the financial core, adoption increasingly hinges on unglamorous real-world plumbing: compliance reviews, banking connections, KYC processes, treasury controls, and interoperability with existing rails. Why? Because even the most elegant crypto network, protocol, or app is useless until someone builds the bridge between the onchain and offchain worlds.

This is especially true for B2B stablecoin platforms. Stablecoin startups are not selling to crypto diehards; they’re selling to enterprises, banks, and fintechs. Their clients grasp the benefits of stablecoin rails, but not how to implement or scale them efficiently. A generic API won’t solve that. What an incumbent needs to embed stablecoins into its card network is nothing like what a small fintech needs for cross-border payroll.

Onboarding legacy institutions means crypto engineers must initially adapt every setup for every partner, like it or not.

That’s why the most ambitious crypto start-ups will inevitably formalise the FDE model. The payoff for this hands-on approach is meaningful: the companies that “white-glove” their early customers tend to win bigger contracts and build deeper, stickier relationships. The alternative—pontificating on 𝕏, defending maximalist purity, and avoiding the messy bits—leads nowhere.

So here’s to the forward-deployed engineers, the unsung sherpas who are turning crypto theory into durable financial infrastructure.

Numbers Of The Week

News Bites

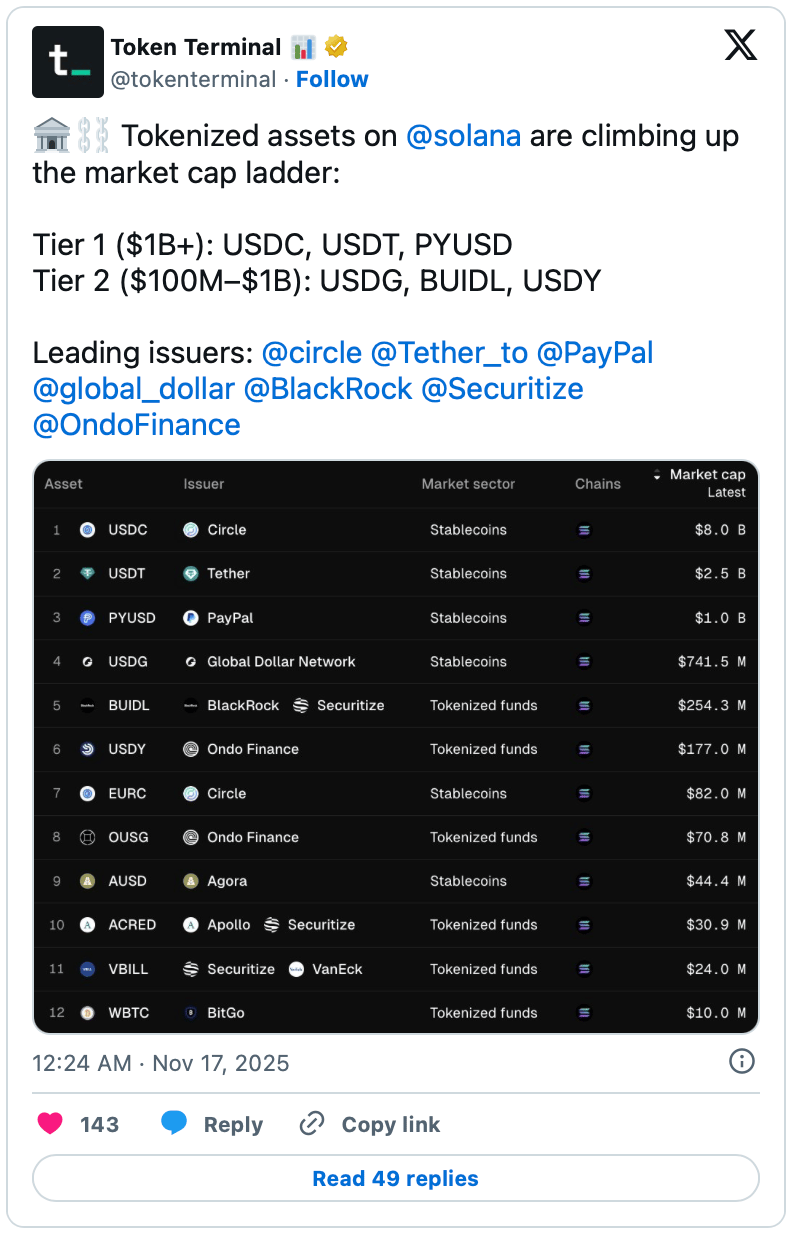

Stablecoin Flows: Leveraging test USDC from Circle, Citi and Swift simulated near-production settlement flows between fiat and crypto with an ease that would have been unthinkable even a year ago. For global payments, the trail hints at a future where tokenised dollars become the connective tissue rather than the experiment.

Stablecoin Payments: Under the hood, Slash is powered by a financial stack that looks less like a bank and more like a settlement engine running at internet speed. The payoff is a climb to $150 million in annualised revenue, driven in part by stablecoins that chip away at traditional banking workflows.

Crypto Transfers: Mastercard’s decision to extend its Crypto Credential programme to self-custody wallets marks a quiet but notable shift toward mainstreaming onchain transfers. By replacing long wallet strings with verified aliases, the company aims to make crypto transactions feel as familiar as sending an email. Yet beneath the consumer-friendly gloss sits a clear cypherpunk play: reducing friction without ever compromising control of private keys.

Machine Economy: EMVCo’s move to develop global specifications for “agentic payments” acknowledges the coming shift toward AI-driven transaction flows. However, the absence of any reference to stablecoins in its communications leaves open the question of what these autonomous payments will actually run on. Whether the specifications gravitate toward tokenised money or traditional rails, the stakes are nothing short of defining who powers the machine economy.

Holding Crypto: Only recently, regulators all but waved red flags at banks dabbling in digital assets, warning of outsized risks. Now the OCC has reversed course, confirming that national banks in the US may hold crypto to pay blockchain transaction fees—effectively licensing them to step onto the rails they once treated with suspicion. The move signals a recognition that engaging with public blockchains is no longer experimental but operational.

Bitcoin Bonds: New Hampshire’s approval of a $100 million Bitcoin-backed conduit bond is the kind of financial innovation that once belonged to conference-hall hypotheticals. The structure lets companies borrow against over-collateralised Bitcoin held by a private custodian, nudging digital assets into the orbit of public-sector finance. If replicated, it could open a new chapter in how global debt markets interface with crypto.

Caught In 4K

Weekly Take

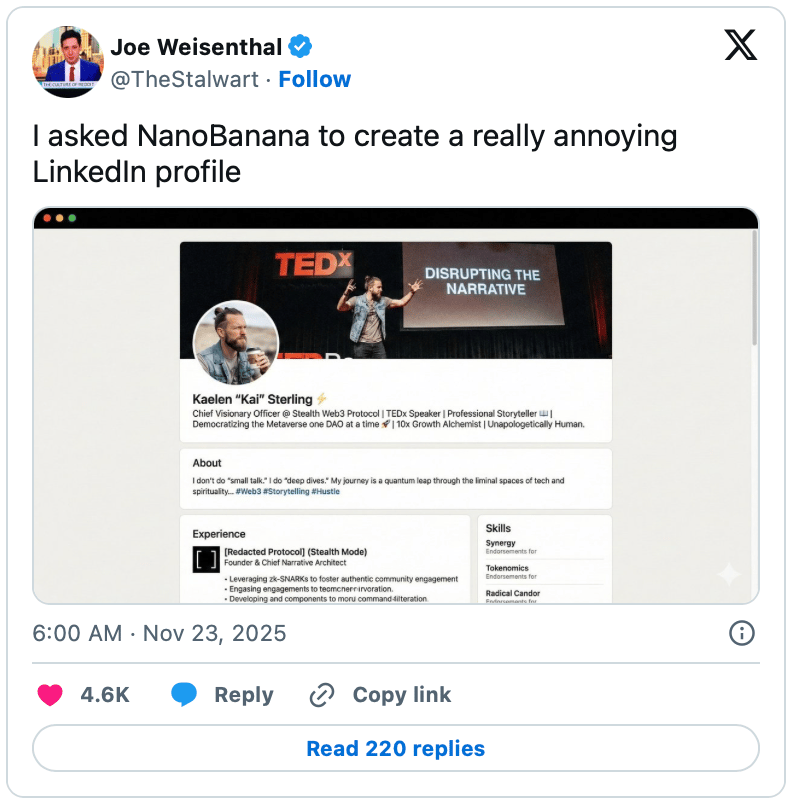

Keks & Giggles

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.