- The Sleuth

- Posts

- Coinbase Takes On Kalshi & Polymarket, North Korea’s $2 Billion Crypto Heist & More

Coinbase Takes On Kalshi & Polymarket, North Korea’s $2 Billion Crypto Heist & More

Also: Shift4 targets Stripe & PayPal in stablecoin rivalry.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

Prediction Markets: Coinbase enters prediction markets via acquisition.

Onchain Rails: Shift4 launches stablecoin settlement platform.

Crypto Heist: North Korea stole ~$2 billion in crypto in 2025.

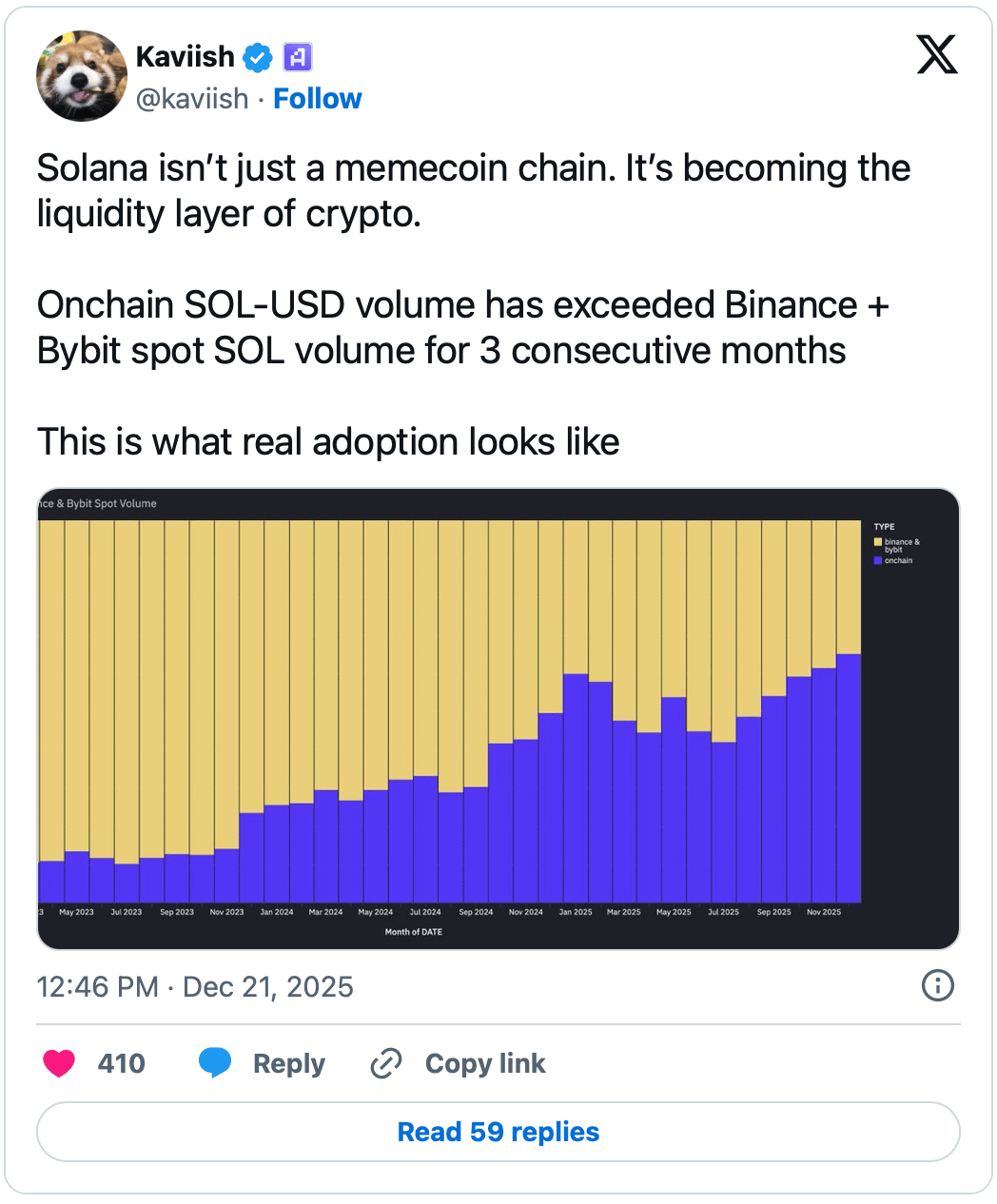

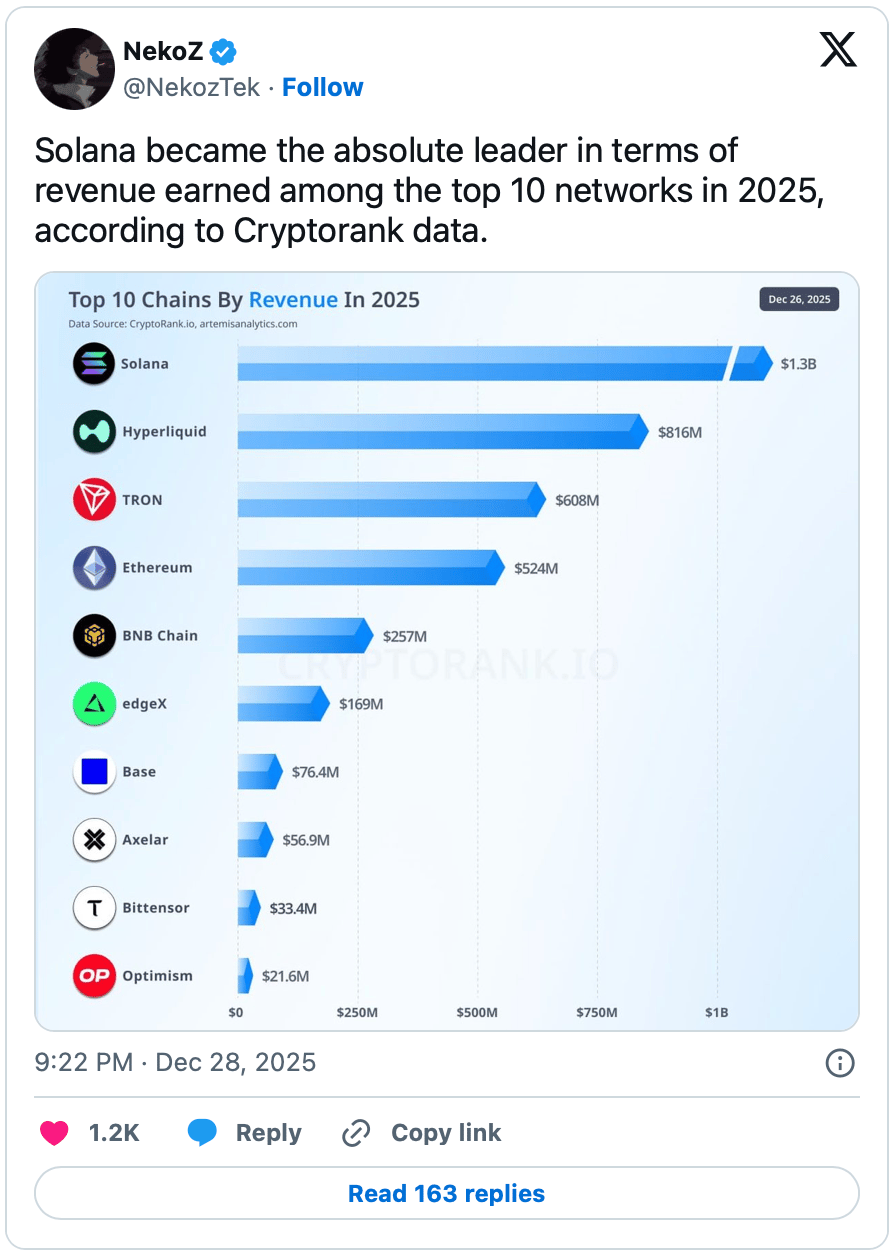

Solana graduating from meme casino to liquidity backbone is what happens when product-market fit beats narrative snark—capital goes where execution is cheapest and fastest.

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Generation Moonshot

Across the globe, young people are navigating an unprecedented squeeze on their ambition.

Artificial intelligence casts a long shadow over career security, while social media amplifies a constant sense of falling behind. Every scroll delivers curated success stories, ensuring that even genuine progress can feel inadequate.

All of this unfolds against a harsher economic backdrop. Housing has drifted out of reach, student debt has ballooned, and wages have struggled to keep pace with living costs. For many young adults, the traditional milestones their parents achieved now appear distant or entirely unattainable.

The result is a pervasive sense of being economically cornered.

When people feel trapped, their relationship with risk changes. A steady 5–10% annual return in the stock market loses its appeal if it still requires decades to achieve financial independence. Faced with such a slow grind, swinging for the fences begins to feel less reckless and more rational.

This helps explain why so many young investors gravitate toward high-variance bets. They understand the odds are unfavourable, but they also recognise that the alternative may be a near certainty of standing still. In that context, risk becomes a form of protest against stagnation.

Among the available options, crypto holds a distinctive allure.

Unlike the job or stock markets, crypto offers a sense of agency that younger generations crave. Outcomes appear less dependent on gatekeepers, credentials, or opaque hierarchies, and more on personal research, conviction, and timing.

For younger investors, crypto is not a frivolous side wager. It sits at the center of how they believe they can close the gap in an economy that feels tilted against them. The message from global youth is strikingly consistent: we will not wait forty years for a chance at financial freedom. We will seek tools and platforms that match our urgency and reshape the risk-reward equation.

Not everyone will succeed, and many will fail.

But the impulse itself deserves to be understood, not mocked. These choices are a rational response to prolonged constraint. Therefore, the more constructive path forward is to channel this moonshot mentality into platforms that are self custodial, transparent, and inclusive—places where ambition can find a real outlet, initiative is rewarded, and where effort actually compounds.

Chart Of The Week

News Bites

Prediction Markets: The prediction-markets sector is becoming markedly more competitive. Kalshi and Polymarket are expanding their reach through partnerships, while incumbents such as Robinhood push vertically into proprietary offerings. With Coinbase entering the fray via its acquisition of The Clearing Company, the market is poised for another pure-play entrant, intensifying competition even further.

Crypto Hacks: North Korean hackers stole an estimated $2bn in cryptocurrency in 2025, a 51% increase year-on-year, lifting cumulative thefts to $6.75bn. According to Chainalysis, the North Korean regime has focused on fewer but far more lucrative operations, such as embedding IT workers inside crypto firms or deploying sophisticated impersonation campaigns aimed at senior executives.

Decentralised Power: Recent weeks have been dominated by debates over crypto prices, ETFs, and privacy—yet decentralised physical infrastructure remains one of crypto’s more compelling frontiers. In this context, Fuse Energy is increasingly gaining momentum for its attempt to rebuild elements of the energy system from the ground up on Solana.

Order Flow: While payment for order flow is well documented in traditional markets, little has been publicly disclosed about how it operates on Solana. Against this backdrop, Meridian’s Benedict has published a report that sheds light on the mechanics of order routing and monetisation on Solana.

Onchain Rails: Shift4 has launched a global stablecoin settlement platform designed to rival the stablecoin offerings of Stripe and PayPal. The service allows hundreds of thousands of businesses to receive funds more quickly and operate around the clock, sidestepping the limits of banks and traditional financial intermediaries.

Caught In 4K

Weekly Take

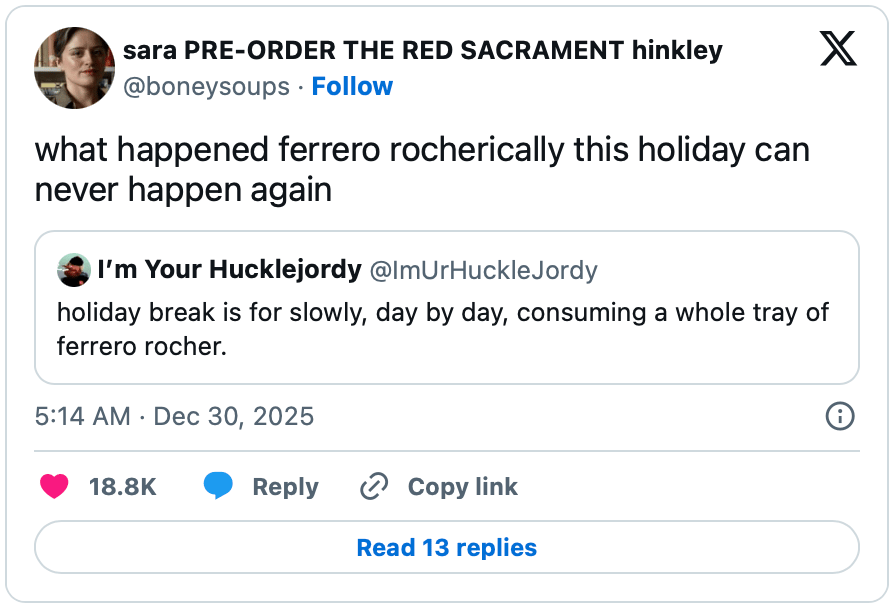

Keks & Giggles

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.