- The Sleuth

- Posts

- Elon Musk’s Stealth Stablecoin Project, BlackRock’s Crypto Cash Cow & More

Elon Musk’s Stealth Stablecoin Project, BlackRock’s Crypto Cash Cow & More

Also: Robinhood vs. Polymarket and Kalshi.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

𝕏 Money: Is Elon Musk preparing 𝕏 for a stablecoin-powered future?

Prediction Markets: Robinhood to challenge Polymarket & Kalshi.

Bitcoin Flows: BlackRock’s Bitcoin ETFs dominate revenues.

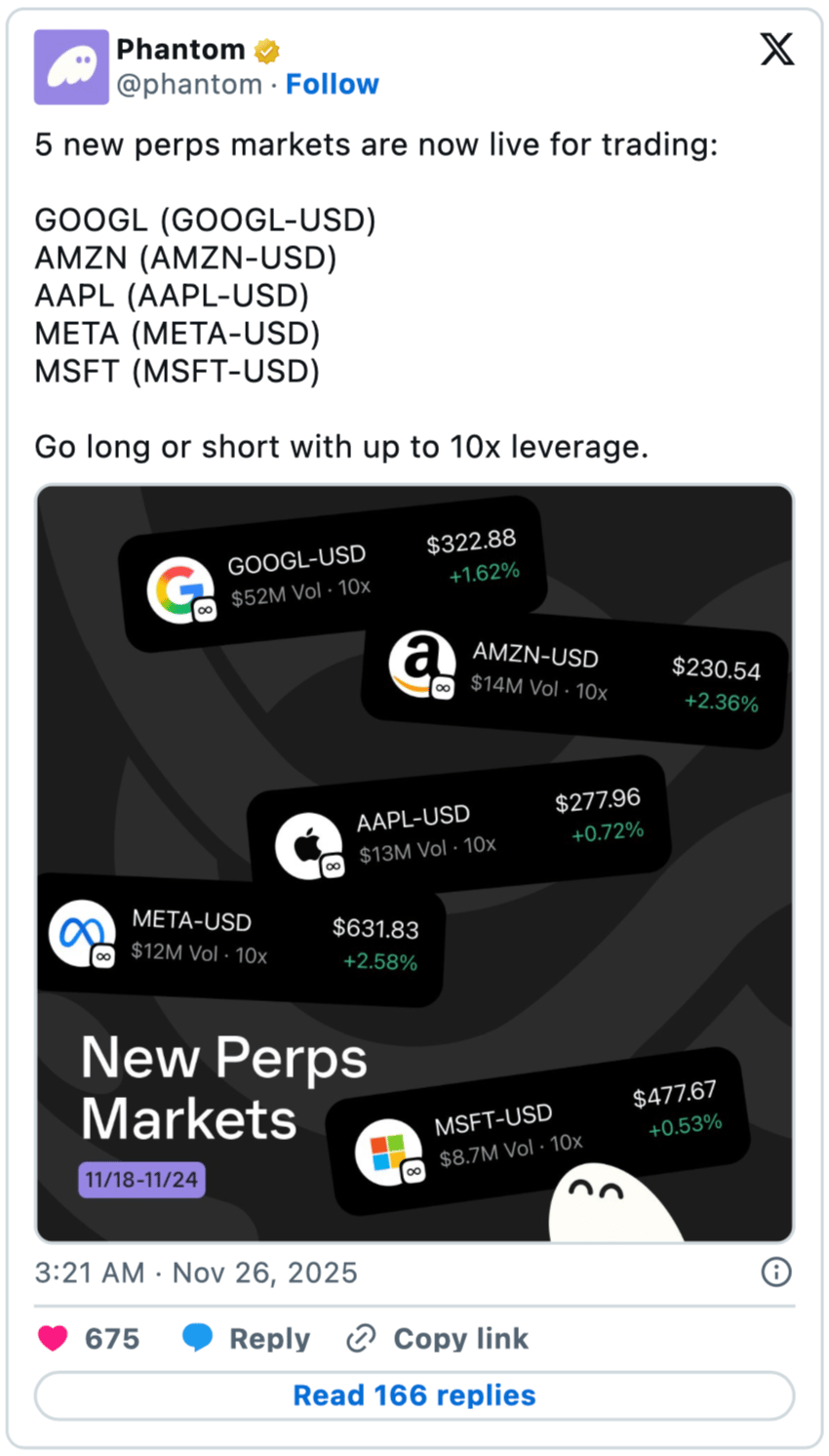

Perpetual futures for some of the most-traded equities just landed on Phantom. You can now trade crypto and stocks side-by-side on the same self-custodial platform, which is basically the Holy Grail of retail investing. Add Phantom Cash, a new stablecoin suite, and you’re looking at the early innings of an everything app.

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Human Signal

From deepfake scams to AI-generated disinformation and bot-driven political manipulation, the very fabric of digital trust is fraying. The internet, which once promised a globally connected human network, is at risk of becoming overrun by automated agents, synthetic identities, and opaque systems.

Consequently, proof of humanity, the concept of cryptographically verifying human uniqueness and presence without surrendering privacy, is rapidly emerging as digital infrastructure we may soon consider essential.

Traditionally, identity verification has been handled by centralised institutions such as governments or tech companies—entities that struggle to respect individual sovereignty. Accordingly, trust in centralised authorities is declining.

A decentralised approach, where no single party controls the identity registry and participants themselves can verify one another, could be transformative. This is where blockchain technology enters the conversation: not as a speculation accelerant, but as a neutral, globally coordinated ledger that enables humans—not governments or corporations—to establish digital personhood that is verifiable, secure, and portable.

Additionally, privacy-preserving technologies such as zero-knowledge proofs can enable systems where someone can prove they are uniquely human without revealing their face, location, or legal identity. This could make it possible to vote online without fear of coercion, access financial services without invasive disclosure, and differentiate human-written content from AI-generated noise—all while maintaining the principles of anonymity and autonomy.

Such innovation, however, carries risk. If improperly implemented, proof of humanity could lead to surveillance, exclusion of those unable to meet verification criteria, or governance capture by early adopters. The intention should not be to create a passport for the internet, but to ensure individuals retain sovereignty when navigating digital environments increasingly populated by non-human intelligences.

As we move toward a future where AI will write articles, negotiate contracts, and even participate in political discourse, distinguishing human agency becomes a democratic and economic imperative.

The question is no longer whether proof of humanity will matter, but how it will be designed, who will govern it, and whether it will empower or constrain.

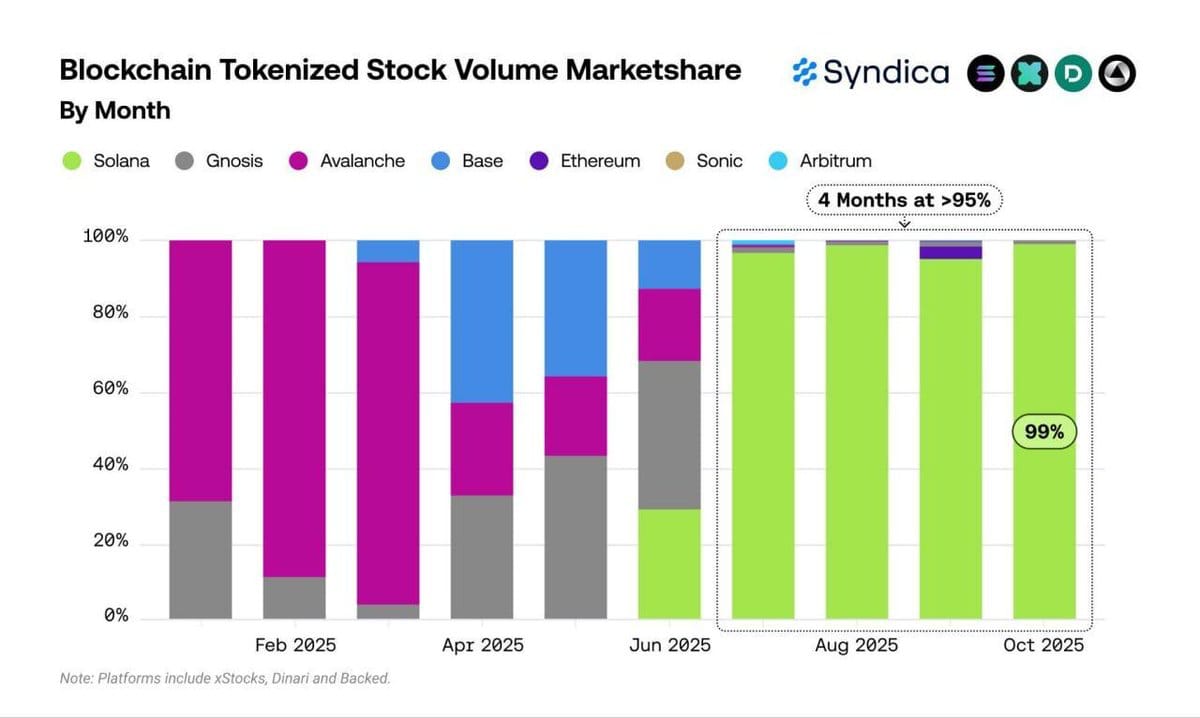

Chart Of The Week

News Bites

𝕏 Money: According to a recent job posting, Elon Musk's 𝕏 is moving to accelerate development of a new payments platform. The language of the posting indicates a potential openness to blockchain infrastructure, with stablecoin rails as a possible foundation for the stack. While the firm has offered no public roadmap, the hire underscores 𝕏’s intent to compress build times and push deeper into next-generation digital payments plumbing.

Prediction Markets: Robinhood has partnered with Susquehanna to launch a new CFTC-licensed exchange and clearinghouse through a joint venture, broadening its expansion into regulated prediction markets. Prediction markets quickly became Robinhood’s fastest-growing revenue line, with 9 billion contracts traded by more than 1 million customers within a single year of launch.

Welcome, Vanguard! As anticipated in September, Vanguard will from today permit ETFs and mutual funds with primary exposure to selected cryptocurrencies such as Bitcoin and Solana to trade on its platform. The shift marks a notable departure from the firm’s long-held resistance and scepticism toward digital assets.

Bitcoin Flows: BlackRock’s Bitcoin ETF business has emerged as the firm’s top revenue driver—an outcome that has confounded expectations at an institution with more than 1,400 ETFs and $13.4tn in total AUM. IBIT alone now holds over 3 % of Bitcoin’s total circulating supply, positioning BlackRock among the asset’s largest single holders globally.

Bitcoin Reserve: Texas has not yet operationalised a Strategic Bitcoin Reserve, but it has acquired $5 million of exposure via BlackRock’s IBIT as an interim proxy. A further $5 million has been earmarked, as state legislators weigh the prospect of a formal Bitcoin reserve programme.

Stablecoin Unification: Visa has partnered with infrastructure provider Aquanow to extend stablecoin settlement capacity across the EMEA region. The partnership will support settlement in approved stablecoins such as USDC, with the explicit aim of reducing network costs and accelerating finality for issuers and merchants.

Kimchi Wars: South Korea’s conglomerates have entered a competitive stablecoin cycle, led by KakaoBank’s work on a Korean-won-pegged token. Its key domestic rival, Naver, is finalising its merger with Upbit, South Korea’s largest digital asset exchange, marking a deeper move into crypto trading and stablecoin issuance.

Reshaping Payments: Swedish fintech giant Klarna has announced plans to issue a US dollar-backed stablecoin, KlarnaUSD, becoming the latest major incumbent to embed digital assets into its settlement strategy. The token is still in testing, but the company has committed to deploying it in 2026.

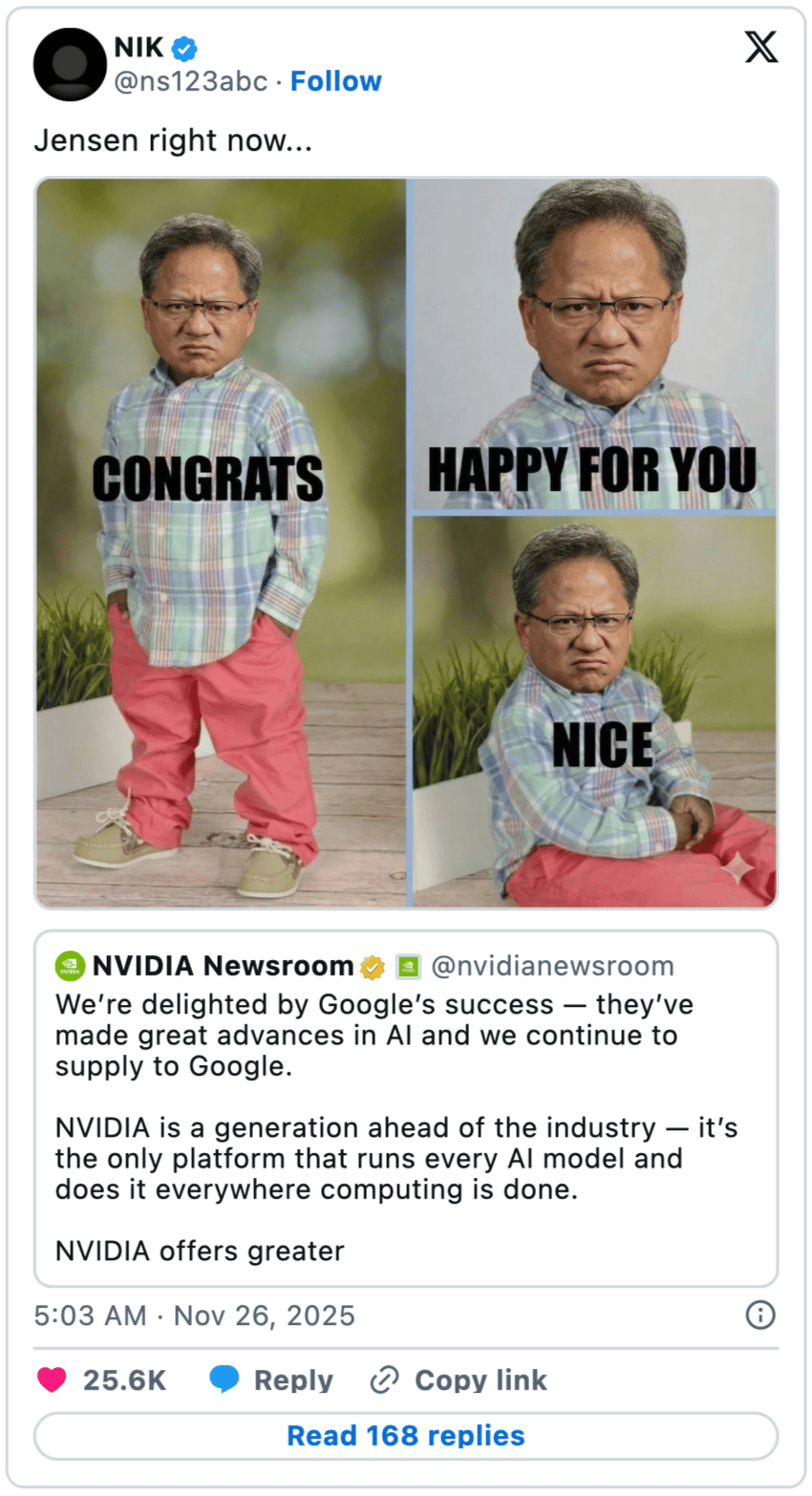

Caught In 4K

Weekly Take

Keks & Giggles

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.