- The Sleuth

- Posts

- JPMorgan vs. Blackrock Crypto Clash, Fidelity’s Solana Expansion & More

JPMorgan vs. Blackrock Crypto Clash, Fidelity’s Solana Expansion & More

Also: OpenAI’s Project Mercury & its crypto implications.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

Godzilla vs. Kong: JPMorgan Chase and BlackRock battle for crypto loans.

American Expansion: Fidelity rolls out support for Solana (SOL).

Project Mercury: OpenAI is training AI models for finance.

Stablecoins were supposed to be the side salad. Turns out, they’re the main course—and the market’s ordering seconds.

One of my favorite charts in all of crypto - stablecoin transaction volume decoupling from spot trading volume

Source @a16z@a16zcrypto

— Patrick Hansen (@paddi_hansen)

9:20 AM • Oct 23, 2025

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Platforms & Protocols

Let me tilt your lens.

JPMorgan Chase’s fiercest rival is not Bank of America, BNP Paribas, or Deutsche Bank.

Its crypto platforms such as Phantom.

For decades, legacy banks controlled customer deposits and the interest generated from them, even as fintechs polished the front end with slicker user interfaces and faster transfers.

Now, stablecoins are changing the equation.

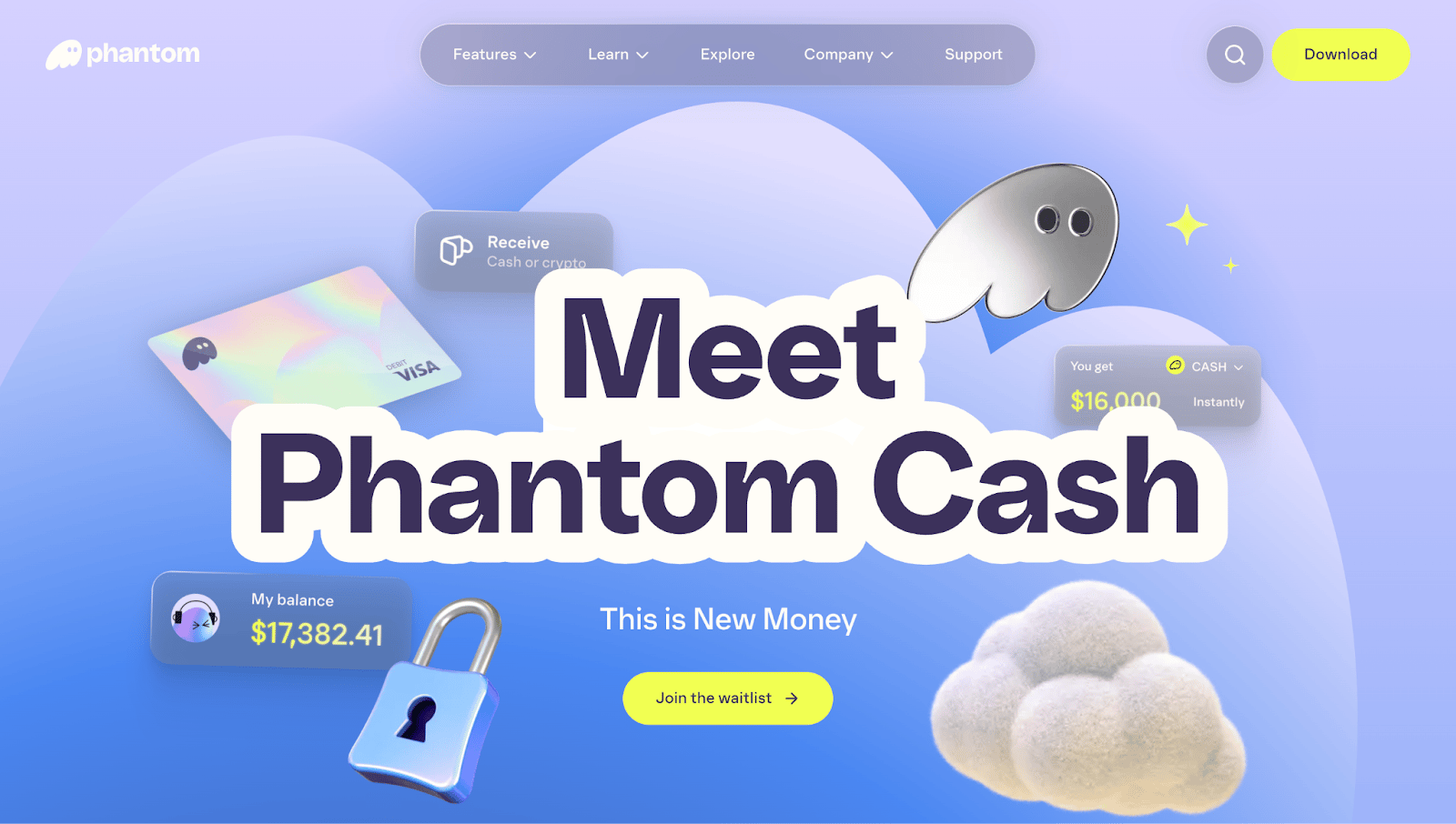

Once money migrates into tokenised form, it no longer requires a bank as its resting place. Instead, balances can be held and transacted entirely onchain, with users retaining custody. Consequently, platforms such as Phantom have begun to evolve into fully fledged financial hubs. Through Phantom Cash, users can receive, send, and spend dollars without relying on intermediary bank accounts. Additionally, they can earn high yields on their stablecoin holdings—offering returns that possibly surpass those offered by legacy banks.

Having said that, the implications extend beyond better deposit rates.

Crypto platforms such as Phantom are building vertically integrated “super-apps” on blockchain rails. They attract and retain customers, allow them to self custody high-yield deposits, facilitate trading across conventional and digital assets, and provide payments rails. By collapsing multiple layers of financial intermediation into a single interface, they are increasingly seizing functions that once defined the banking industry.

For incumbents, the danger is clear. Control of deposits, long the foundation of banking power, is beginning to slip away—the same goes for the high-margin businesses in trading and payments.

The writing is on the wall: the locus of trust and utility is increasingly shifting from limestone towers to lines of code. The next era of banking will not be built through branches and balance sheets, but through platforms and protocols designed to capture the value of digital dollars at scale.

Numbers Of The Week

Post-mortem reveals:

Solana leads all major crypto networks in performance during the AWS outage, with no throughput impact

Additionally, Solana is #1 in resilience with by far the lowest % of stake residing in AWS

— Solana (@solana)

5:21 AM • Oct 22, 2025

News Bites

Godzilla vs. Kong: Crypto investors have been swapping their Bitcoin for shares of BlackRock’s IBIT ETF, enabling them to use those holdings more easily as collateral, for borrowing, and in estate planning. That workaround may soon be redundant, as JPMorgan Chase intends to accept Bitcoin directly as collateral for institutional loans by year-end.

Don’t wait until your banker tells you to buy Bitcoin.

— Michael Saylor (@saylor)

1:13 PM • Oct 24, 2025

American Expansion: Fidelity has rolled out support for Solana (SOL) custody and trading to all its US brokerage customers. This allows investors to hold Solana (SOL) directly alongside traditional equities, bonds, and mutual funds on a single platform.

BREAKING: @Fidelity, the asset manager with $5.8 Trillion in AUM, makes SOL accessible for all US brokerage customers 🔥

— Solana (@solana)

1:37 PM • Oct 23, 2025

Solana ETFs: The Bitwise Solana (SOL) Spot ETF is expected to make its debut on the New York Stock Exchange today, with rival offerings from Grayscale and VanEck likely to follow soon. These vehicles mark the first spot ETFs tied directly to Solana (SOL) in the US, providing investors with straightforward exposure to the token.

Wow Factor: T Rowe Price, a top-five US asset manager with $1.77 trillion under management, has filed for an actively managed crypto ETF that will include Solana (SOL). The application marks the firm’s first direct step into digital assets, nearly two years after the SEC authorised spot Bitcoin ETFs.

Crypto Holdings: Filings with the Securities and Exchange Commission reveal that Citadel and its founder Kenneth Griffin hold a significant stake in DFDV, a Solana-focused treasury company. The disclosure suggests Solana (SOL) is gaining traction not just among retail investors, but also within the highest echelons of finance.

Project Mercury: OpenAI has hired more than 100 former bankers from Goldman Sachs, JPMorgan, and Morgan Stanley for a secretive initiative known as Project Mercury. The programme is designed to train AI models to handle the labour-intensive tasks of IPOs, M&A, and restructurings, traditionally the preserve of junior bankers. With OpenAI’s acquisition of Roi and the growing role of tokenisation and stablecoins in corporate finance, Project Mercury may offer an early glimpse into how crypto is integrated into AI-powered financial workflows.

Skinny Accounts: The Federal Reserve is weighing the creation of so-called “skinny master accounts,” which would give fintechs and crypto firms direct access to its payment rails. These accounts would carry no interest, limit balances, exclude overdraft facilities, and bar access to the Fed’s discount window. If adopted, however, the change would erode one of traditional banks’ deepest moats, potentially shifting more of the payments value chain to crypto-native players.

Stablecoin Pivot: Western Union disclosed in its Q3 2025 earnings call that it is piloting global fiat-to-stablecoin transfer services. The trials, running across multiple markets, aim to position the company as a bridge between remittances and digital currency flows. If successful, the pivot could give Western Union renewed relevance in an industry increasingly dominated by stablecoin rails.

Product Unlock: Wise, one of the world’s leading neobanks, is preparing to enter the crypto sector. The company is exploring stablecoins as a way to enhance and expand on its core strength in international transfers, as well as unlock whole new categories of products.

Caught In 4K

NEW: BlackRock's #Bitcoin exchange traded product is now officially trading on the London Stock Exchange 🇬🇧

— Bitcoin Magazine (@BitcoinMagazine)

6:07 PM • Oct 21, 2025

Weekly Take

hardest part for any app in crypto is longevity

— nairolf (@0xNairolf)

5:25 AM • Oct 24, 2025

Keks & Giggles

I do find this just amazing

— Tom Goodwin (@tomfgoodwin)

4:10 PM • Oct 23, 2025

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.