- The Sleuth

- Posts

- Morgan Stanley Goes All-In On Solana, BNY's New Tokenised Deposits & More

Morgan Stanley Goes All-In On Solana, BNY's New Tokenised Deposits & More

Also: How Claude Opus 4.5 unlocks Solana's scale.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

Solana ETFs: Morgan Stanley seeks approval for Solana spot ETF.

Tokenised Deposits: BNY has enabled tokenised bank deposits.

Vibe Coding: How Solana’s LLM-driven future could unfold.

Accepting crypto as collateral isn’t about belief, it’s about math. And math has a way of ending cultural arguments quickly.

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Risk Rewired

Asset classes once served as intellectual silos, separating investors by mandate and mindset.

A stock-picker rarely ventured into commodities; a bond trader seldom strayed into equities. These distinctions were as much cultural as they were financial, reinforced by regulation, professional identity, and the limits of technology.

That architecture is now dissolving. Modern trading platforms increasingly combine multiple asset classes under a single roof, enabling the same user to move seamlessly from buying stocks to trading cryptocurrencies, hedging foreign exchange exposure, or wagering on election outcomes or sporting events.

The reason for this shift is not primarily technological, but cognitive. Most traders and investors no longer think in neat asset buckets. They think in probabilities and payoffs. Markets, viewed this way, are simply different instruments for expressing a view about an uncertain future. As such, a conviction about inflation can be translated into an energy equity, a short position in government bonds, a currency trade, or a prediction market linked to a central bank decision.

What matters is not the wrapper, but the expected outcome.

In that sense, every asset is a language for expressing belief. Consequently, the growing appeal of financial super apps reflects an interface finally catching up with how users already reason about risk.

This logic points to an inevitable convergence: crypto-native platforms will feel pressure to offer equities, foreign exchange, and prediction markets. Retail brokerages will continue to absorb derivatives and cryptocurrencies. And equally, prediction market platforms are likely to broaden their scope, moving beyond event contracts to encompass the buying and trading of cryptocurrencies, equities, and other conventional asset classes.

The more interesting question, then, is how these platforms will compete once they all resemble one another.

In this context, two factors are likely to matter the most.

The first is narrative. As markets multiply and instruments proliferate, attention becomes a scarce resource. The winners will be those with well-run content engines that educate, contextualise, and continually pull users back into the ecosystem.

The second is control. Platforms that offer genuine self custody—allowing users to own and move their assets without reliance on an intermediary—will be structurally more attractive in a world increasingly wary of counterparty risk.

Simply put: in a future where belief is the core commodity, scale will belong to platforms that combine persuasion with true ownership.

Chart Of The Week

News Bites

Solana ETFs: Morgan Stanley has filed for regulatory approval to launch both Bitcoin and Solana spot ETFs, marking the first such move by a major US bank. The step signals a notable shift in institutional posture, bringing a once-peripheral asset class closer to the financial mainstream.

Tokenised Deposits: BNY, the world’s largest custodial bank, now allows institutional clients to settle tokenised bank deposits on its private blockchain. While the move represents a meaningful milestone, it also highlights the limits of closed systems. Public blockchains such as Solana offer shared infrastructure, real-time transparency, and global composability that internal ledgers struggle to match.

Asset Tokenisation: Deutsche Bank quietly used the holiday lull to publish a slide deck arguing that blockchains i.e. tokenisation could become the default infrastructure for issuance and trading by the 2030s, a trajectory as sketched out by BNY above. If correct, this would recast blockchain rails from an efficiency upgrade into a structural necessity.

Wyoming Stablecoin: Wyoming has issued the Solana-based Wyoming Frontier Stable Token (FRNT), the first blockchain-native asset backed by a US state. Issued under the Wyoming Stable Token Act, the coin is overcollateralised, with reserves held in trust and invested solely in dollars and short-duration US Treasuries. Interest generated from those reserves will be directed towards funding Wyoming’s school programmes.

Oi, Mate! Barclays has taken a stake in Ubyx, a stablecoin clearing system, marking its first investment of this kind. The move forms part of the bank’s stated ambition to explore “new forms of digital money”. It also underscores how stablecoins are increasingly viewed less as a crypto novelty and more as financial plumbing.

Vibe Coding: The next wave of Solana smart contracts may increasingly be written by large language models rather than humans. If realised, this would further compress development cycles and accelerate financial experimentation on the network. A recent deep dive into building a proprietary AMM with Claude offers a glimpse of what this LLM-driven future on Solana could look like.

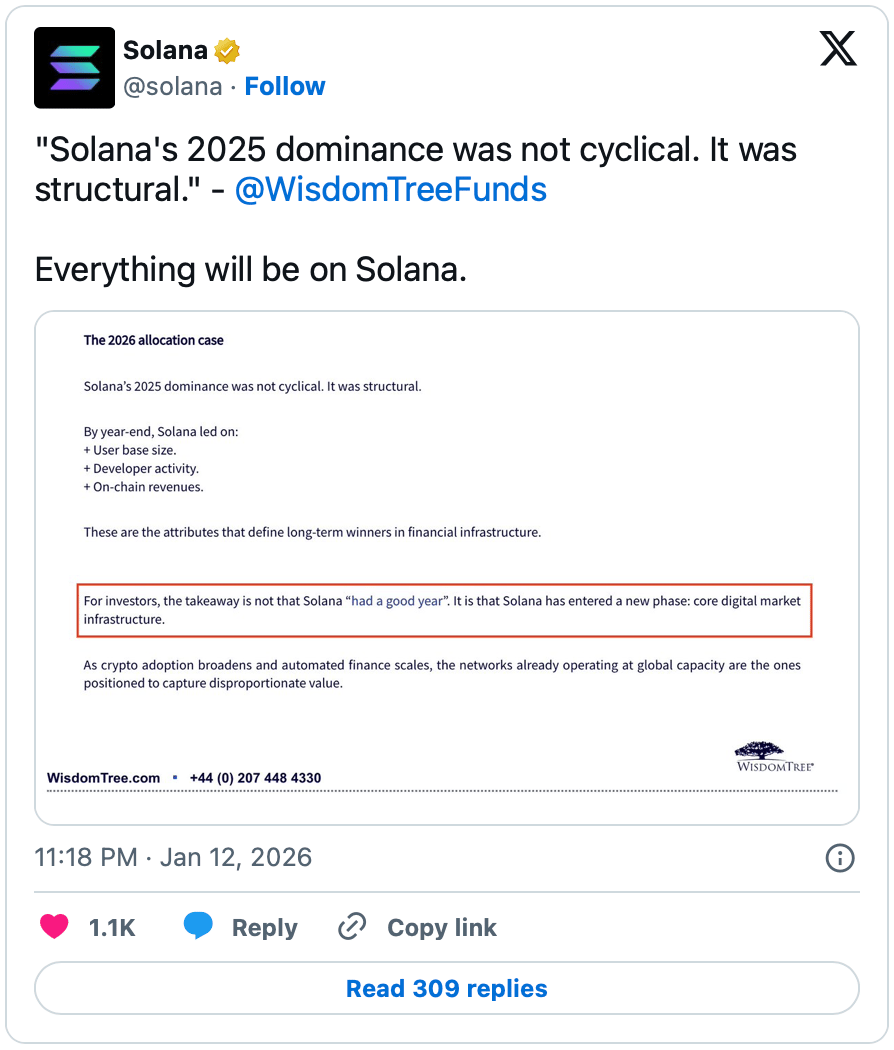

Caught In 4K

Weekly Take

Keks & Giggles

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.