- The Sleuth

- Posts

- Venezuela’s Shadow Bitcoin Treasury, Russia’s New Sanctions-Proof Stablecoin & More

Venezuela’s Shadow Bitcoin Treasury, Russia’s New Sanctions-Proof Stablecoin & More

Also: Polymarket enters US real estate market.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

Shadow Economy: How A7A5, a rouble-backed stablecoin, gained traction.

Maduro Indictment: Sources estimate Venezuela could hold $60bn in Bitcoin.

Prediction Markets: Polymarket traders can now speculate on house prices.

Onchain trading is winning because it lets users keep control and capture more upside. If capital is voting with its feet, Solana is where the smart money is sprinting.

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Infinite Authenticity

The line between real and artificial content is blurring beyond recognition.

In other words, authenticity itself is becoming infinitely reproducible.

When seeing is no longer believing, society faces a profound challenge: how do we preserve trust?

As a response, lawmakers and platforms have proposed labels to identify AI-generated content. But relying on detection and labelling is an uphill battle, as AI detectors are locked in an arms race with ever-evolving content generators. In short, playing whack-a-mole with AI content is unsustainable. Without a more fundamental solution, the deluge of AI slop will continue to undercut our confidence in what we see, read, and hear.

A better approach is to prove what’s real from the moment of creation. That's why a growing number of voices are calling for cryptographic provenance: the embedding of a tamper-proof fingerprint into content at the moment it is created. Cameras, platforms, and apps would digitally sign texts, photos, and videos as they are created, embedding metadata on when, where, and by whom they were captured.

Crucially, this flips the script: instead of trying to spot AI content, we elevate verified reality. Authentic content would carry a kind of digital watermark of trust, while anything without credentials would (rightly) invite skepticism.

Additionally, a16z has suggested the notion of staked media. In this context, staking means a content creator locks up a specified amount of cryptocurrency alongside each content piece released. If the content is later proven false or misleading, the stake can be partially or entirely forfeited; if it holds up, the creator can either earn fees on the staked assets or reclaim them—all while steadily building a credible reputation.

The appeal of the approach is not that it eliminates deception entirely, but that it reshapes incentives. Today’s information economy rewards speed, virality and outrage, while the penalties for falsehood are often diffuse or nonexistent. Staked media inverts that logic by making credibility a scarce and valuable asset. Put differently: it introduces friction precisely where none exists today.

Importantly, a16z does not frame staked media as a replacement for cryptographic provenance or detection systems, but as a complement. Cryptographic signing can prove where media came from; staking signals confidence in its truth. Together, they point toward an internet where authenticity is not just asserted, but economically enforced.

No solution is perfect, of course, and bad actors will undoubtedly seek to exploit any system. Yet doing nothing is not an option. If we fail to establish reliable authenticity signals, we risk drowning in a sea of convincing illusions.

An information society cannot function on perpetual scepticism; it needs islands of certainty. Therefore, investing in proof of reality is not just a technical upgrade—it is a societal imperative.

Numbers Of The Week

News Bites

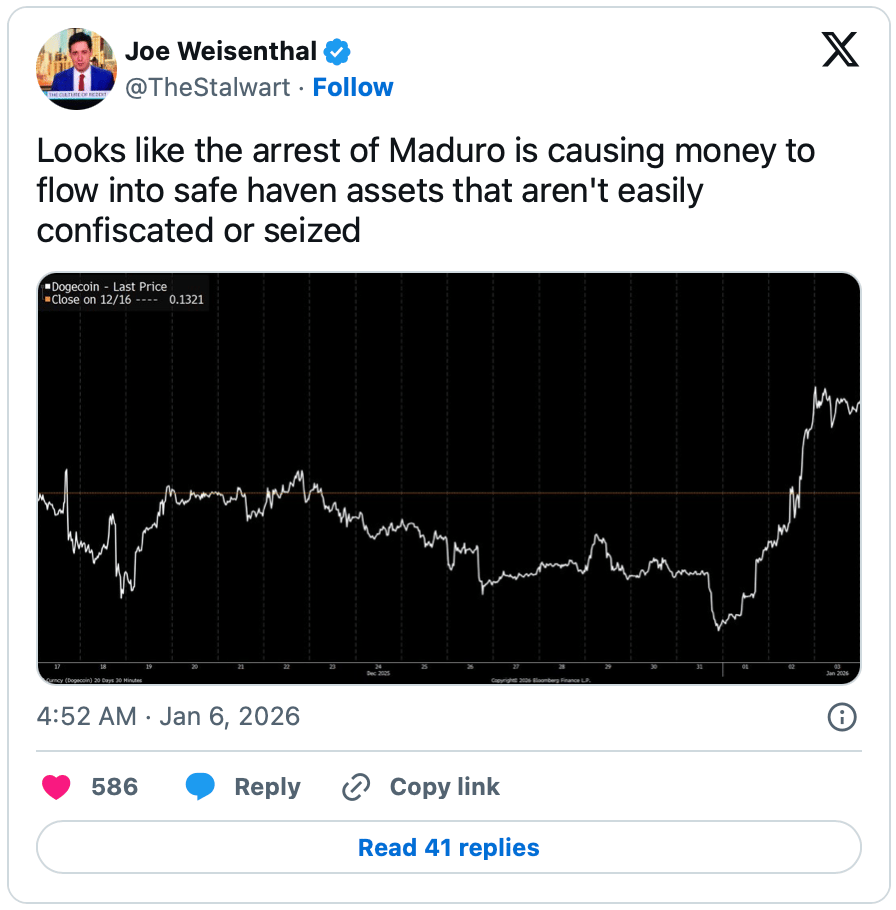

Maduro Indictment: The Maduro indictment has thrust Venezuela firmly into the global spotlight. The country has long turned to crypto as a workaround for sanctions, currency collapse, and a dysfunctional banking system, allegedly under the stewardship of fixer Alex Saab. On this basis, sources estimate that Venezuela could hold as much as $60bn in Bitcoin, a sum that would rank among the largest sovereign-scale crypto treasuries if confirmed.

Shadow Economy: Sceptics often argue there is little demand for non-dollar stablecoins, yet recent developments suggest otherwise. Circle’s euro-denominated EURC offers one counterpoint. Additionally, A7A5, a rouble-backed stablecoin, has increasingly gained traction—largely as a tool to evade sanctions. As programmable money becomes ubiquitous, regulators face the delicate task of containing illicit uses without undermining the genuine progress stablecoin rails are making in modernising the financial system.

Prediction Markets: Polymarket has partnered with Parcl, a real-estate investing application built on Solana, to launch contracts tied to US home values. Traders can now speculate on median real estate prices nationally and across major cities including New York, Los Angeles, San Francisco, Miami, and Austin.

Nippon Rising: At the Tokyo Stock Exchange’s New Year opening ceremony, Japan’s finance minister Satsuki Katayama signalled a decisive shift towards folding cryptocurrencies into the country’s established market framework. The message was clear: digital assets should be accessed through recognised exchanges and governed by securities-style rules, not a parallel system.

Crypto Cards: Spending on Visa-issued crypto cards surged in 2025, with total net spend rising more than 500% YoY. According to estimates, six blockchain-linked cards issued in partnership with Visa grew from $15mn in monthly net spend in January 2025 to $90mn by December 2025.

Wrench Attacks: Crypto holders are increasingly being targeted by violent home invasions and kidnappings designed to extract their assets by force, a trend that has unsettled even seasoned investors. Data compiled by Jameson Lopp shows not only a steady rise in such incidents over time, but a marked escalation in their brutality.

Data Breach: Ledger suffered a data breach via payment processor Global-e, exposing customer names and contact details. The incident revives uncomfortable questions about whether the industry’s best-known cold wallet brand truly represents the gold standard for long-term asset storage after repeated security lapses—particularly in the context of rising wrench attacks.

Caught In 4K

Weekly Take

Keks & Giggles

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.