- The Sleuth

- Posts

- Goldman Sachs Accelerates Stablecoin Strategy, NYSE Launches 24/7 Trading & More

Goldman Sachs Accelerates Stablecoin Strategy, NYSE Launches 24/7 Trading & More

Also: Vanguard expands Bitcoin access.

Welcome back!

This is J264G and this week I’ve got these titbits for you:

Mainstream Adoption: Goldman Sachs explores stablecoins & tokenisation.

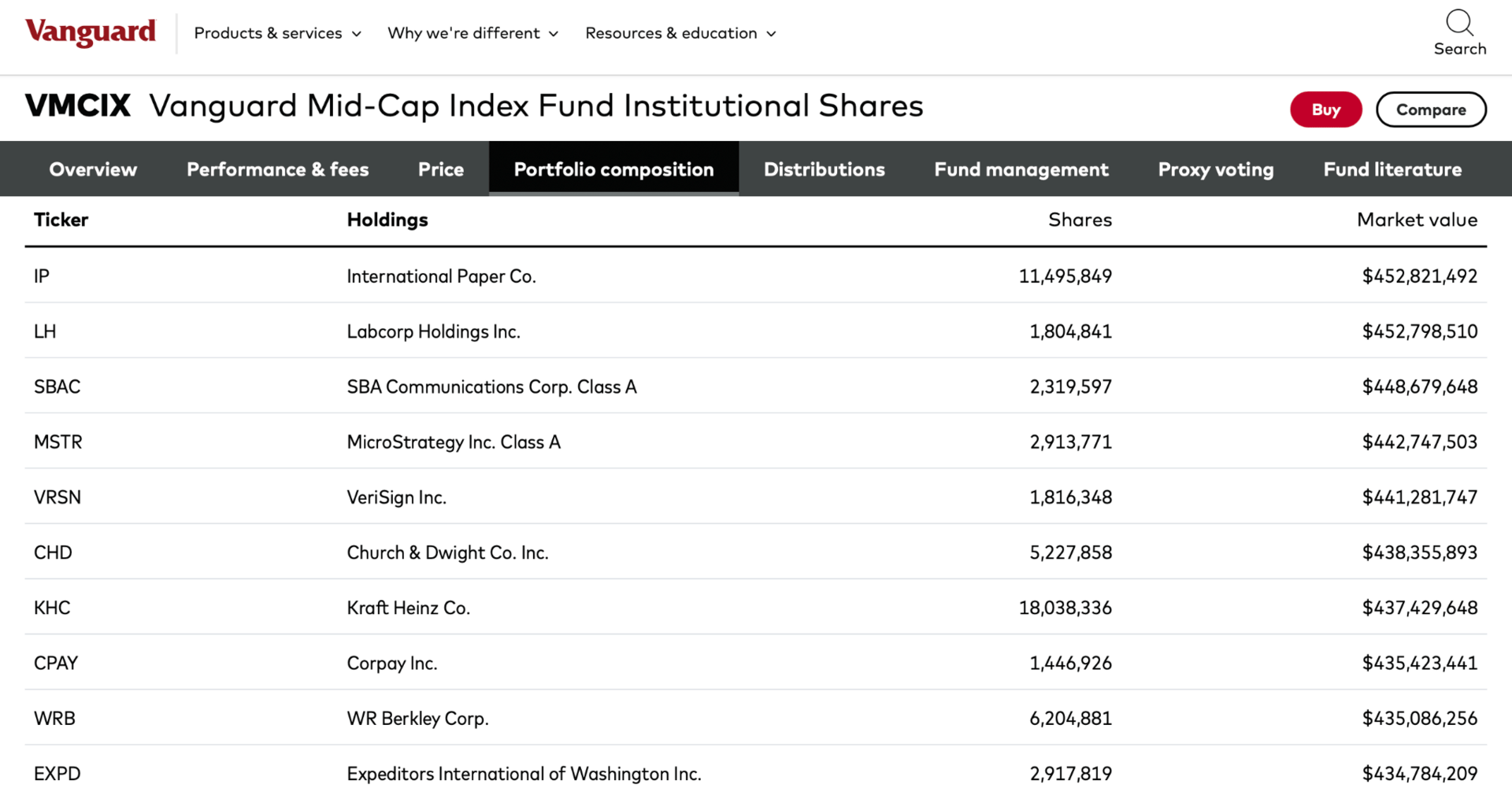

Bitcoin Endorsement: Vanguard acquires 2.91 million shares of Strategy.

Tokenisation Acceleration: NYSE to launch 24/7 securities trading.

Financial institutions don’t adopt new technology out of ideology—they adopt it when it lowers costs and expands margins, and Bitcoin is starting to do both.

Now, let’s jump right into this week’s newsletter!

Click on any underlined heading/hyperlink to learn more.

Spotlight

Earned Allegiance

The rise of cryptocurrencies and privacy tools is quietly, but decisively, eroding the traditional power of nation-states.

What is changing is not merely the form of money, but its relationship to territory. For centuries, currency was inseparable from geography, institutions and borders, binding economic life to the jurisdiction in which it was issued and enforced.

That linkage is now loosening.

Money is becoming increasingly abstracted from place. Cryptographic systems allow value to be held, moved, and secured independently of any single jurisdiction, weakening the long-standing assumption that capital naturally resides within the state. A private key, rather than a bank account, becomes the locus of ownership. In practical terms, this means wealth can exist outside the immediate reach of national authorities, even while remaining fully liquid and globally transferable.

The net effect is a reduced ability of governments to act unilaterally over private assets. Capital controls, forced conversions, arbitrary freezes, and opaque interventions lose much of their force when individuals can store and transmit value beyond traditional rails. Having said that, cryptography does not abolish the state’s role in finance, but it constrains discretion and reduces asymmetries of power. And in doing so, it reshapes the balance of leverage between individuals and the institutions that govern them.

The behavioural consequences are subtle yet profound. People are increasingly empowered to behave less like passive subjects of a nation and more like discerning customers of governance. Consequently, if a country debases its currency, expands financial surveillance, or introduces unpredictable rules, those with mobile capital can respond not through protest or compliance, but through quiet reallocation.

Jurisdiction becomes a variable, not a given.

Trying to dam this river of technological change is futile. A more durable response lies in adaptive governance: treating citizens as stakeholders with choices, rather than captives without alternatives. Sound monetary policy, regulatory clarity, and restraint in surveillance become competitive advantages, encouraging people to remain economically and socially invested in a given system.

Stripped to its essence: the balance of power is shifting, not from state to anarchy, but from governments that assume loyalty to those that earn it.

Chart Of The Week

News Bites

Mainstream Adoption: Goldman Sachs chief executive David Solomon said the bank is actively exploring both stablecoins and tokenisation. He added that Goldman is also looking into prediction markets, with a particular focus on products regulated by the CFTC.

Bitcoin Endorsement: Vanguard has acquired 2.91 million shares of Strategy (MSTR) for its Mid-Cap Index Fund, marking the stock’s first inclusion in the vehicle. While indirect, the allocation increases the fund’s exposure to Bitcoin and illustrates how passive strategies can incrementally absorb crypto-linked assets without changing their mandates.

Tokenisation Acceleration: Intercontinental Exchange, the owner of the New York Stock Exchange, is seeking approval from the SEC for a blockchain-based platform it hopes to launch later this year, enabling 24/7 trading of tokenised securities alongside instant stablecoin funding and settlement. The apparent decision to run the system on a private blockchain, while offering control and regulatory comfort, revives familiar concerns around self custody, interoperability, and long-term scalability, as discussed in this newsletter last week.

Stablecoin Rails: Interactive Brokers has enabled 24/7 account funding using USDC on Solana, marking a notable expansion of round-the-clock access to digital dollars. In general, it further underscores how mainstream brokerages are testing blockchain rails to compress settlement times and extend market hours.

Solana Decentralisation: The team behind the Overclock validator has released an alpha version of Mithril, a full node client designed to verify Solana’s mainnet on modest hardware and home internet connections. The result is a tangible step toward greater decentralisation and resilience across the Solana network.

Caught In 4K

Weekly Take

Keks & Giggles

And that's a wrap!

You can reach me anytime over on 𝕏 or drop me a line.

Talk soon!

DISCLAIMER

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. Lastly, please be advised that we discuss products and services from our partners from which our team members may hold tokens/equity.